Spotting the Next Big Thing: Upcoming Investment Trends

In the fast-paced world of investing, keeping an eye on upcoming trends is crucial to staying ahead of the game. As the saying goes, The early bird catches the worm, and in the world of investments, being able to spot the next big thing can mean the difference between success and failure.

One of the key strategies for successful investing is to anticipate where the market is heading and to position yourself accordingly. This requires a keen eye for spotting emerging trends and an understanding of how they may impact various industries and sectors. By staying informed and being proactive, investors can capitalize on new opportunities before they become mainstream.

One of the current trends that investors should be paying close attention to is the rise of sustainable and socially responsible investing. With increasing awareness of environmental and social issues, more and more investors are looking to put their money into companies that are making a positive impact on the world. This trend is not only driven by a sense of social responsibility but also by the potential for long-term financial returns as these companies are often well-positioned for future growth.

Another trend to watch out for is the increasing importance of technology in the investment world. With advancements in artificial intelligence, machine learning, and data analytics, investors now have access to more information and tools than ever before. This has led to the rise of robo-advisors and algorithmic trading, which are changing the way investments are managed and executed.

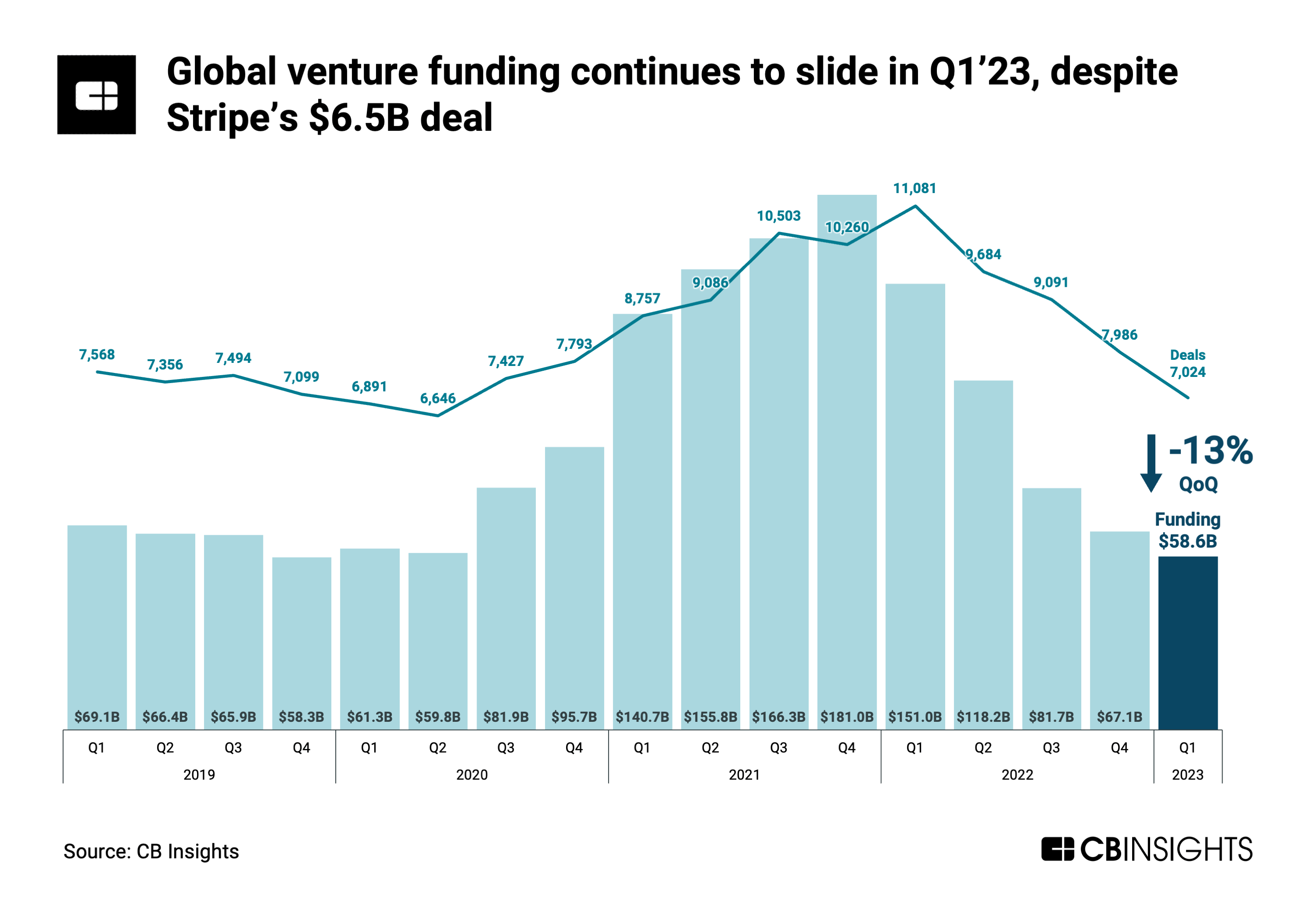

Image Source: cbinsights.com

Cryptocurrency and blockchain technology are also areas that are worth keeping an eye on. While still relatively new and volatile, cryptocurrencies have the potential to revolutionize the financial industry and create new opportunities for investors. Understanding how these technologies work and how they may impact traditional markets can give investors a competitive edge.

On a more macroeconomic level, demographic trends are also important to consider when making investment decisions. The aging population in many developed countries, for example, is creating opportunities in healthcare, pharmaceuticals, and senior living industries. Similarly, the rise of the millennial generation is driving demand for experiences over material possessions, leading to growth in sectors such as travel, entertainment, and wellness.

In conclusion, keeping an eye on upcoming investment trends is essential for success in the ever-changing world of finance. By staying informed, being proactive, and adapting to new opportunities, investors can position themselves for long-term growth and profitability. So, don’t wait for the next big thing to pass you by – start spotting those trends today and stay ahead of the game!

Stay Ahead of the Game with These Investment Tips!

In today’s fast-paced world, keeping an eye on upcoming investment trends is crucial for staying ahead of the game. As the market constantly evolves, it is important to stay informed and be prepared to take advantage of new opportunities. Whether you are a seasoned investor or just starting out, these investment tips will help you navigate the ever-changing landscape of the financial world.

One of the key tips for staying ahead of the game is to diversify your portfolio. By spreading your investments across different asset classes, you can reduce risk and increase your chances of earning a higher return. This can include investing in stocks, bonds, real estate, and even alternative investments such as cryptocurrencies or precious metals. Diversification is essential for weathering market fluctuations and ensuring long-term growth.

Another important tip is to stay informed about current market trends and economic indicators. By paying attention to news and events that could impact the financial markets, you can make more informed investment decisions. This can include monitoring interest rates, inflation rates, geopolitical events, and industry trends. Being proactive and staying ahead of the curve will give you a competitive edge in the investment world.

In addition to diversifying your portfolio and staying informed, it is also important to set clear investment goals and stick to a disciplined investment strategy. Whether you are investing for retirement, education, or wealth accumulation, having a clear plan in place will help you stay focused and avoid making impulsive decisions. By setting specific goals and timelines, you can track your progress and make adjustments as needed.

Furthermore, staying ahead of the game also means being open to new opportunities and emerging markets. As technology continues to advance and new industries emerge, there are constantly new investment opportunities to explore. Whether it’s investing in cutting-edge technologies like artificial intelligence and renewable energy or exploring emerging markets in developing countries, being open-minded and willing to take calculated risks can lead to lucrative returns.

One of the most important tips for staying ahead of the game is to continuously educate yourself and seek advice from financial experts. The investment landscape is constantly evolving, and it is important to stay up-to-date on the latest trends and strategies. Whether it’s reading books, attending seminars, or consulting with a financial advisor, investing in your knowledge and skills will pay off in the long run.

In conclusion, staying ahead of the game with these investment tips is essential for success in today’s fast-paced financial world. By diversifying your portfolio, staying informed, setting clear goals, exploring new opportunities, and continuously educating yourself, you can position yourself for long-term growth and prosperity. Remember, the key to successful investing is to be proactive, disciplined, and open-minded. So keep an eye on upcoming investment trends and stay ahead of the game!

Top Investment Trends to Watch in the Coming Year