Protecting Your Wealth: Strategies for Beating Inflation

In today’s fast-paced world, it’s more important than ever to safeguard your investments against the effects of inflation. As prices continue to rise, the value of your money can quickly diminish if you’re not careful. But fear not! There are plenty of strategies you can implement to beat inflation and protect your wealth for the long haul.

One of the most effective ways to beat inflation is by investing in assets that tend to outperform the rate of inflation. This can include stocks, real estate, and commodities such as gold and silver. By diversifying your portfolio with these types of assets, you can help ensure that your investments keep pace with or even outpace inflation.

Another strategy for beating inflation is to invest in Treasury Inflation-Protected Securities (TIPS). These government-issued bonds are specifically designed to protect against inflation by adjusting their principal value based on changes in the Consumer Price Index. By investing in TIPS, you can guarantee that your investment will keep up with the rate of inflation, providing you with a reliable hedge against rising prices.

In addition to investing in inflation-beating assets, it’s also important to regularly review and adjust your investment portfolio to ensure that it remains aligned with your financial goals. By staying informed about market trends and economic indicators, you can make informed decisions about when to buy, sell, or hold onto your investments in order to maximize your returns and minimize the impact of inflation.

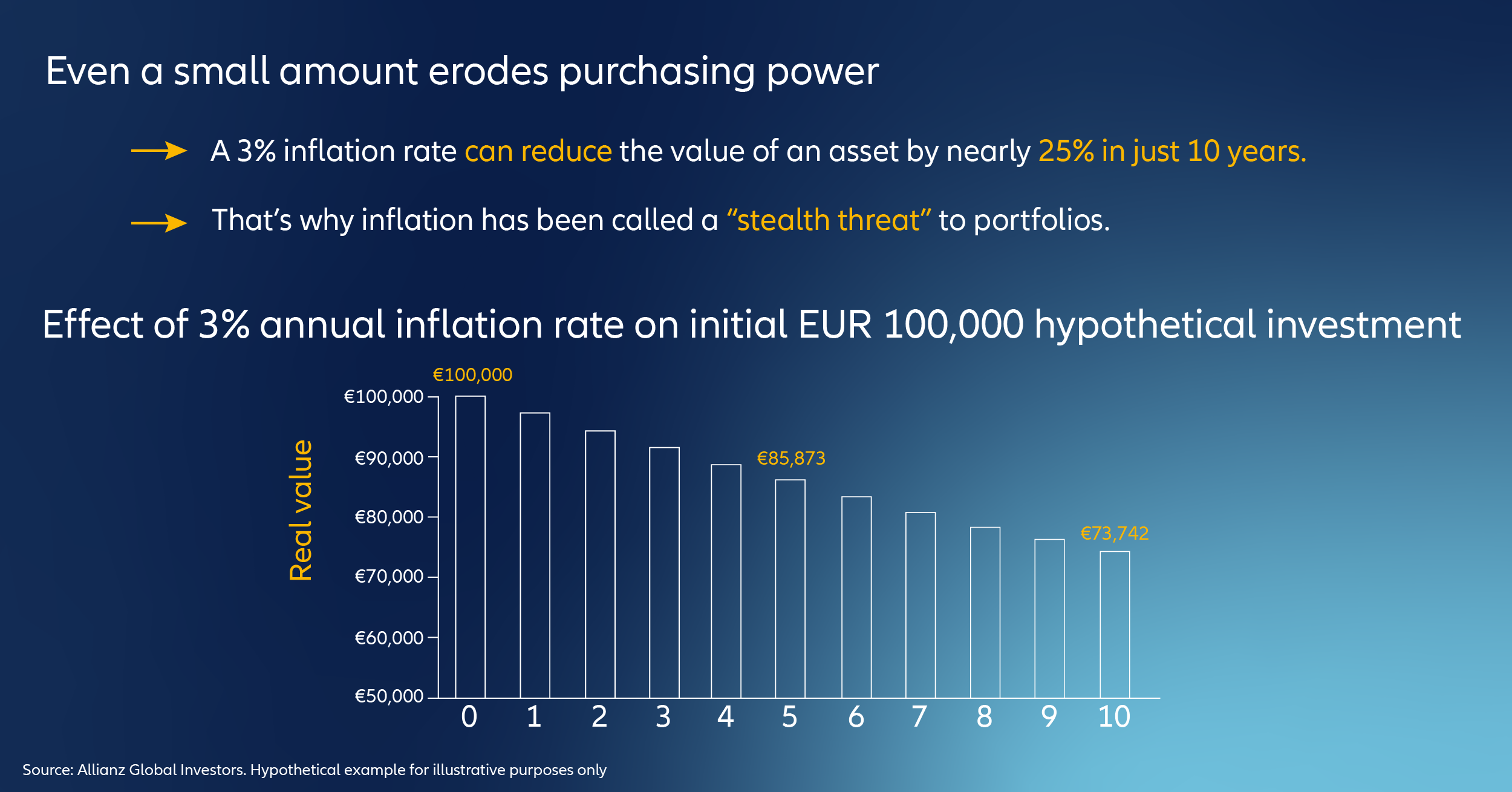

Image Source: allianz.com

One often overlooked strategy for beating inflation is to focus on increasing your income through various means such as side hustles, passive income streams, or career advancement. By boosting your earning potential, you can offset the effects of inflation and continue to grow your wealth over time.

Furthermore, it’s crucial to keep an eye on your expenses and look for ways to cut costs and save money wherever possible. By reducing unnecessary spending and living within your means, you can free up more cash to invest in inflation-beating assets and secure your financial future.

Finally, don’t forget to regularly reassess your risk tolerance and financial goals to ensure that your investment strategy remains aligned with your personal objectives. By staying proactive and adaptable, you can navigate the effects of inflation and protect your wealth for years to come.

In conclusion, beating inflation and protecting your wealth requires a proactive and strategic approach to investing. By diversifying your portfolio, investing in inflation-beating assets, increasing your income, controlling expenses, and staying informed about market trends, you can effectively guard your investments against the erosive effects of inflation. So don’t wait, start implementing these strategies today and secure your financial future for tomorrow.

Sailing Smoothly: Tips for Safeguarding Your Investments

When it comes to guarding your investments against the effects of inflation, it’s important to have a well-thought-out strategy in place. Inflation can erode the value of your money over time, making it crucial to take steps to protect your wealth. Here are some tips for sailing smoothly through the choppy waters of inflation and safeguarding your investments.

Diversification is key when it comes to protecting your investments from inflation. By spreading your investments across different asset classes, you can reduce the risk of loss in any one area. This can help mitigate the impact of inflation on your overall portfolio and ensure that you have a more stable financial future.

Another important tip for safeguarding your investments is to stay informed about economic trends and market conditions. By staying up-to-date on the latest news and developments, you can make more informed decisions about where to put your money and when to make changes to your investment strategy. This can help you navigate the effects of inflation more effectively and make the most of your investment opportunities.

In addition to diversification and staying informed, it’s also important to consider investing in assets that have historically outperformed inflation. Assets such as real estate, gold, and commodities have traditionally acted as hedges against inflation, helping to preserve the value of your investments even as prices rise. By including these types of assets in your portfolio, you can better protect your wealth from the effects of inflation.

One often-overlooked tip for safeguarding your investments is to focus on long-term growth rather than short-term gains. While it can be tempting to chase after quick profits, it’s important to remember that investing is a marathon, not a sprint. By focusing on long-term growth potential and staying patient through market fluctuations, you can better weather the effects of inflation and build a more resilient investment portfolio.

Risk management is another important aspect of safeguarding your investments against inflation. By carefully assessing the risks associated with each investment and taking steps to mitigate those risks, you can better protect your wealth from unexpected market downturns or economic changes. This can help you navigate the effects of inflation more effectively and ensure that your investments remain secure over the long term.

Finally, it’s important to regularly review and adjust your investment strategy as needed. Market conditions can change quickly, and it’s important to stay flexible and nimble in response to new developments. By regularly reassessing your investment portfolio and making adjustments as needed, you can better safeguard your investments against inflation and ensure that your wealth continues to grow over time.

In conclusion, safeguarding your investments against the effects of inflation requires a proactive and strategic approach. By diversifying your portfolio, staying informed about economic trends, investing in inflation-resistant assets, focusing on long-term growth, managing risks effectively, and regularly reviewing and adjusting your investment strategy, you can better protect your wealth and sail smoothly through the challenges of inflation. By following these tips, you can navigate the effects of inflation with confidence and ensure a more secure financial future.

The Impact of Inflation on Your Investments and How to Protect Yourself